“I really need this in my life” is just one of many ways we justify our crazy shopping habits. In this technology driven world, more and more millennials have turned to online shopping.

The reason is obvious – convenience, everything we need is only a few clicks away from us. Not only that, but you can online shop now even if your bank account is on the verge of a breakdown.

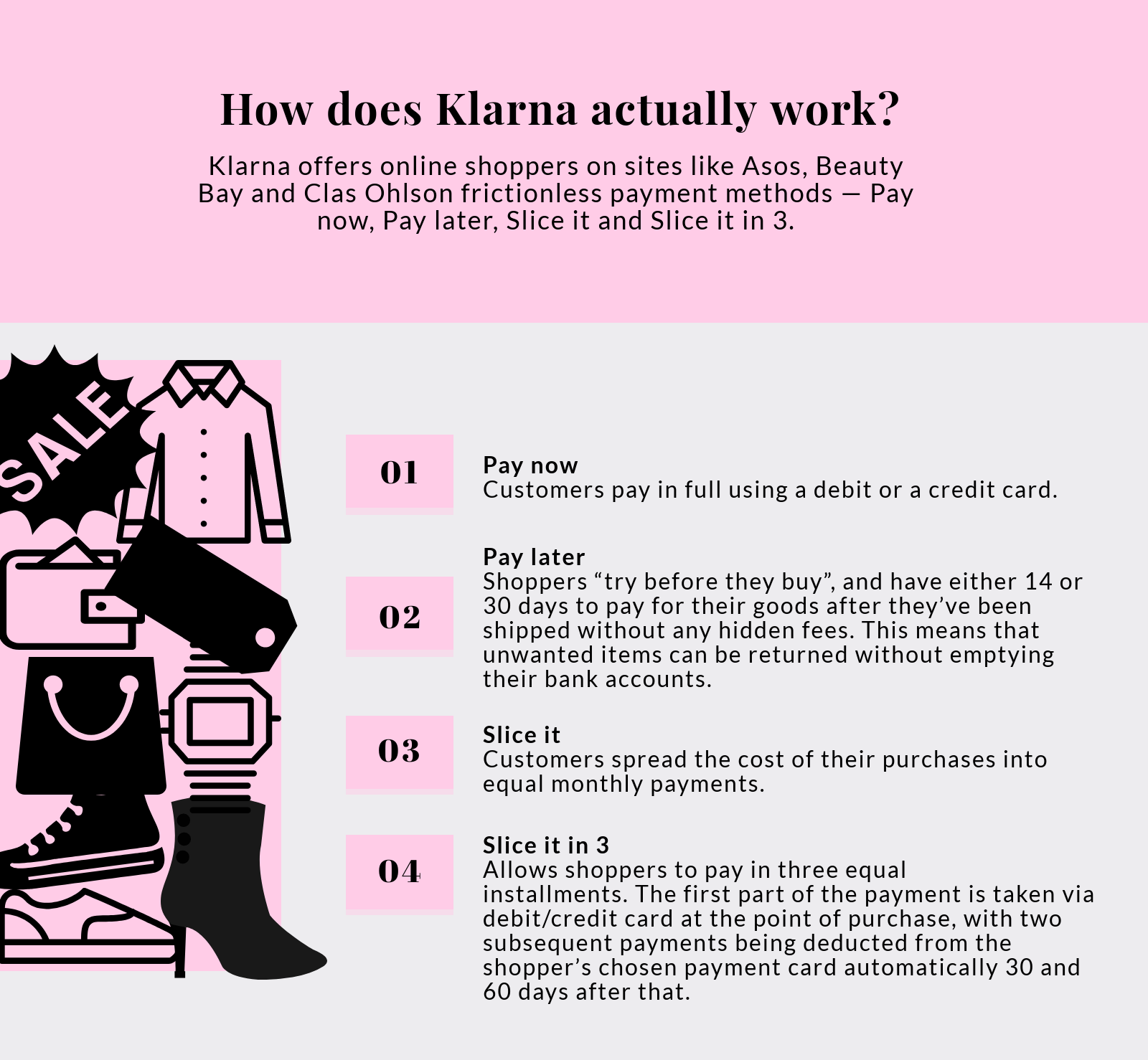

How is this possible? Well, the answer is short and simple – Klarna, a buy now pay later service which has exploded over recent months. Klarna is one of Europe’s largest banks which provides payment solutions for 60 million consumers across 90,000 merchants in 14 countries. You may have noticed their pink sunglasses icon when choosing payment options on sites such as ASOS.

According to Klarna’s team in the UK, the number of new Klarna users is growing by 25,000 each week, and there are one million customers who have used Pay later in the past year.

Now, before you get too excited about going on a crazy shopping spree, you should know that there are certain factors taken into account to determine eligibility. First of all, customers must be at least 18 years old, their previous credit history is checked, and a variety of other factors are considered before you are actually able to use this service.

Infographics by Lucija Duzel | Created with Piktochart

What happens if you are late with your payment?

We spoke to Luke Griffiths, general manager at Klarna UK who told us this: “With Pay later, our most popular product, there is no interest, no fees and no late payment penalties in the UK — ever. Once shoppers have received their goods, they must log in at Klarna.com/uk or via the app to make a payment with their debit or credit card within the 14-30 day window. If their payment card is declined, customers will be directed to provide an alternative payment method.”

What about those who don’t manage to pay back within that window? Luke told us: “We have a communications flow in place which will remind them of their responsibilities. After their repayment window has closed, we try to reach out to them over a period of 120 days to try and re-establish communication and ask for repayments.”

What do customers have to say?

VoL spoke to Anna from London who works in Marketing, and she said: “So far, I’ve had a really positive experience with it and I tend to shop more with online retailers that offer it as a payment type…It’s especially handy if I am buying for a special occasion, such as a wedding, because I can order a couple of options without the upfront cost or journey.”

She reiterated the point that it’s a good way to save time and money: “It saves me time and helps manage my cash flow.”

Anna also pointed out that Klarna isn’t without its flaws: “One flaw, however, is that there isn’t an option to break down the order, so you can immediately pay for the items you want to keep. If I return only some of the items, I have to make sure I’m on the ball with paying it back once the items I have sent back have been processed as returned. Otherwise, my credit rating would be affected.”

Another customer, Conor, PR, West Midlands explained to VoL what happens if you don’t pay on time: “One month I hadn’t paid on time due to ASOS failing to process a return and Klarna sent me a warning letter stating they’d fine me if I didn’t pay soon. I contacted their customer services to explain the situation and they were really quick to extend the payment period by another month.”

Because of Klarna’s quick and understanding customer service team Conor says despite the issues he experienced he’d still recommend Klarna: “I’d definitely recommend it to others, I think it’s a really handy service if you’re online shopping and want to try out a number of styles/sizes without emptying your account.”

However, there has been quite a few customers who expressed their dissatisfaction on Twitter.

Feel like I’m gunna be in debt with Klarna for the rest of my life

— Annie Hill (@anniehillll) October 3, 2018

https://twitter.com/morganmacleodx/status/1021804973334646786

NAHHH as if beauty bay is getting Klarna, being in constant debt to ASOS is bad enough, why this 😭😭😭

— Beth 🧡 (@bethamberhughes) July 17, 2018

Are there any other consequences / negative aspects?

Luke Griffiths pointed out that Klarna is very clear about the downsides: “We’re very clear about how our products affect credit scores. ‘Pay later’, our most popular product in the UK, requires a soft search which does not affect your score. When using ‘Pay later’ your credit score will only be affected after your account goes into arrears. ‘Slice it’ is a credit product and is dependent on a full credit check (hard search), which can affect your credit score.”

So, if you know your limits Klarna is definitely a great way to try before you buy. However, at the same time it might encourage customers to live above their standards which is a dangerous game to play. And if you like treating yourself a bit too much (we’ve all been there)… maybe think twice before clicking on that pink sunglasses icon.

Klarna is a relatively new 'buy now pay later' service available when shopping on sites like Asos and Beauty Bay. Would you consider this as a payment option?

— Voice Of London UK (@VoiceOfLondonUK) December 2, 2018

Words: Lucija Duzel | Subbing: Vanessa Craus, Ruby Naldrett